Dear investor,

Over the summer, our teams have continued to make progress on GE’s transformation into a more focused, simpler, and stronger high-tech industrial company. In Healthcare, we’re advancing precision health, enabling more personalized diagnosis, improving treatments and decision-making, and delivering better clinical outcomes. Customers are expressing more interest as they begin to leverage our advanced data capabilities, like Healthcare’s Edison True PACS, an AI-enabled decision support system to help radiologists adapt to higher workloads and increased exam complexity.

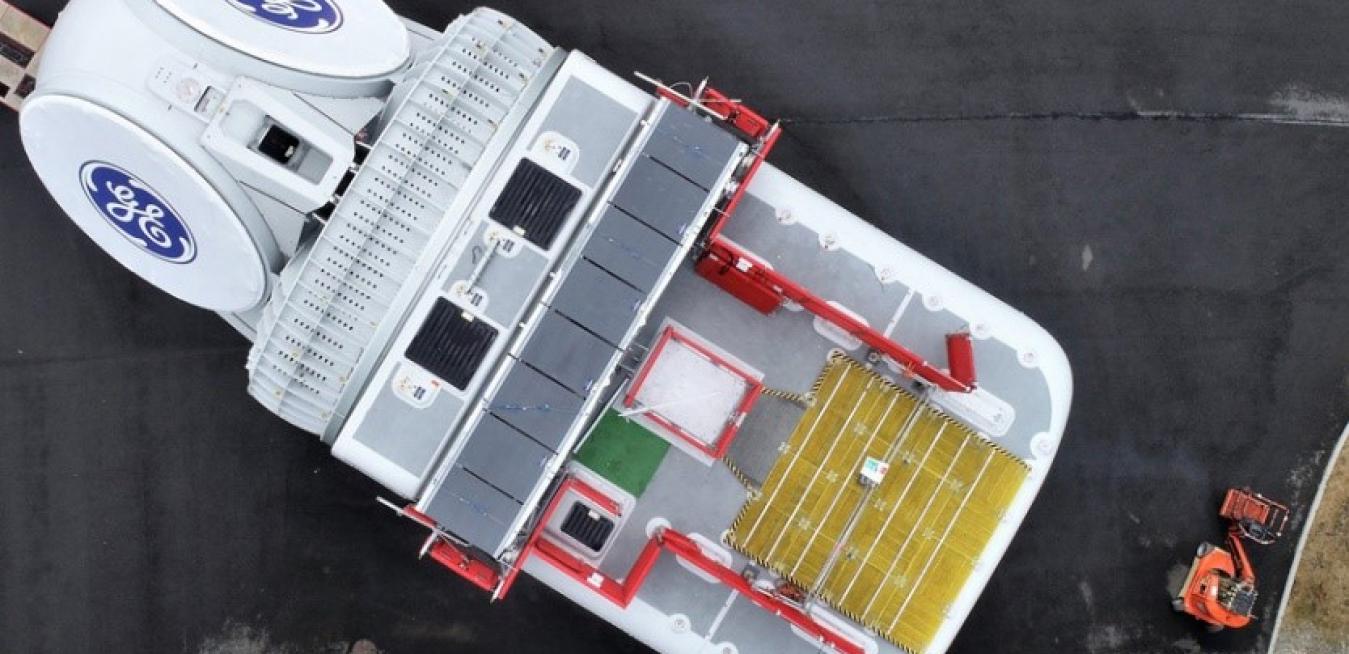

Around the world, our teams are working with our customers on the energy transition. Electrical transmission grid operators are facing increasing demand and complexity as they adapt to bringing on more renewable power sources. GE’s Grid Solutions business offers unique, industry-leading technologies to help grid operators maintain the reliability and efficiency of the power supply for their networks. We recently shared four new projects – two Static Var Compensator (SVC) projects and two Static Synchronous Compensator (STATCOM) projects – which help regulate voltage and increase reliability and efficiency.

Our Digital business is also delivering for our customers. Digital announced the latest release of its Advanced Distribution Management Solution (ADMS), which enables safe and secure management and orchestration of the electricity distribution grid. Additionally, the software business announced a collaboration with Malaysia Airlines to transform and modernize their fuel efficiency program by adopting GE Digital’s Fuel Insight and FlightPulse aviation software. The solution is an integral part of the airline’s on-going efforts to meet its sustainability goals. As noted in our most recent Sustainability report, we are committed to investing in the next generation of breakthrough jet engines and related aviation technologies that build on our 40 percent reduction in CFM engine fuel consumption and CO2 emissions over the last several decades.

As we have done several times, I wanted to share and address some of the most frequent questions my team and I have been hearing in recent weeks following 2Q earnings. These include:

- After the combination of GECAS with AerCap is complete, how will consolidating the rest of GE Capital into GE affect your free cash flow* trajectory?

- The U.S. wind production tax credit (PTC) is due to expire at the end of this year; what could that mean for Renewables’ 2021 free cash flow* prospects?

- Given Power’s strong margins in 2Q, what should we expect not only for the 2nd half of ’21 but longer term?

- We are hearing about continued supply chain shortages globally. What impact do you expect for your Healthcare business this quarter?

- How is your Aviation business trending this quarter in light of the latest COVID-19 Delta variant impact?

- To what extent does CFM, GE’s joint venture with Safran, utilize factoring and how does that impact GE’s free cash flow*?

This month, Larry and Carolina will be kicking off strategy reviews across our businesses which are a regular part of our management processes this time of year. We hope you’ll tune in on September 14 when Larry speaks about GE’s continued transformation at Morgan Stanley’s Laguna Conference.

Lastly, I am pleased to announce that Carolynne Borders has joined GE as Senior Executive Director, Investor Relations. Coming to us from Henry Schein (Nasdaq: HSIC), a Fortune 500 company serving global healthcare distribution markets, Carolynne brings more than 25 years of experience in investor relations and strategic communications.

I hope you find this update useful and, as always, I welcome your feedback.

Best,

Steve

- After the combination of GECAS with AerCap is complete, how will consolidating the rest of GE Capital into GE affect your free cash flow* trajectory?

We expect to complete the transaction this year, and GE will move from reporting GE and GE Capital separately to a simpler single-column reporting – 4 Industrial segments with one balance sheet. Free cash flow* (FCF) will include what remains from GE Capital, excluding Insurance. Some key considerations for FCF* upon the change in our reporting:

- GE Capital operations: While we plan to report the remaining GE Capital activities as part of GE Corporate, we plan to exclude Insurance from certain non-GAAP metrics, including revenue, profit, adjusted earnings/EPS*, and FCF*. Insurance is a regulated business in run-off operation that does not support our industrial businesses. Its cash is restricted and not available for redeployment and is not currently shown as a part of our cash balance. We will continue to provide the same level of disclosure for Insurance that we have provided in our recent filings.

- Interest: Lower debt levels will reduce our ~$3B of interest in 2020 by approximately two thirds in the coming years. After the GECAS transaction closes, we will reduce our debt by ~$35B+ inclusive of debt actions and maturities in ‘21, which will, in turn, reduce our interest expense. And, in ’22 and ’23, we will continue to reduce our debt through maturities and other actions and increase earnings to reach <2.5x net debt/EBITDA. Total debt reduction through 2023 will reduce our consolidated interest expense to ~$1B, and flow through to FCF*.

- Derivatives treatment: We plan to include derivatives cash flow in our definition of FCF* upon consolidation. However, our current level of notional derivatives reflects the amount of debt on our balance sheet, where we are hedging both interest rate and foreign exchange volatility. In line with our reduction of debt, we expect to see the notional derivatives balance decline significantly and along with it, materially lower volatility impact on FCF*.

We remain focused on delivering organic growth and margin expansion, and offsetting working capital needs from volume growth through operational improvements and lean. There is no change to our target of high single digit free cash flow* margins in ‘23+, inclusive of the consolidation impact.

- The U.S. wind production tax credit (PTC) is due to expire at the end of this year; what could that mean for your Renewables’ 2021 free cash flow* prospects?

Congress and the Biden Administration are considering various PTC extension proposals. While we are broadly encouraged by the administration’s support for renewable energy, we believe a blanket long-term PTC extension could lead to deferred investment and push out project development. There are opportunities to avoid unintended consequences delaying development by structuring PTC extensions to create incentives for continued, steady growth in all years. To this end, we are engaged in constructive discussions with multiple key stakeholders.

It’s too early to quantify the specific impact to free cash flow*, but current PTC dynamics present a risk to our second half orders profile and associated progress collections, as customers may not have the immediate incentive to place new orders this year. That said, this is reflected in the current total company guidance range we have provided, and any PTC impact primarily would reflect timing. We continue to focus on what we can control: driving profitable growth, cost out, and working capital efficiency.

- Given Power’s strong margins in 2Q, what should we expect not only for the second half of ‘21 but longer term?

Power continued to perform well in 2Q, with the team driving operational improvements across the business. Gas Power outage starts were up 50% year-over-year as we caught up on deferred outage demand from ’20, due to COVID-19 delays. As we shared during 2Q earnings, 3Q typically has the lowest service activity for our customers compared to spring and fall outage seasons in the Northern hemisphere. As a result, we expect lower sequential margins for Gas Power and our Power business overall.

We remain confident in our full-year outlook for high-single-digit margins at Gas Power, driven by stronger services revenue growth. We’re progressing as planned on our exit of new build coal in Steam, and the rest of the segment continues to execute well. Longer term, we currently expect Power to achieve high-single-digit margins in ’23+, driven by growth in electricity demand, continuing project execution improvements especially in Steam, and expanding operations of our highly valuable HA gas turbine.

- We are hearing about continued supply chain shortages globally. What impact do you expect for your Healthcare business this quarter?

Despite global supply shortages and continued challenges related to COVID-19, we remain encouraged by the performance and long-term prospects of our Healthcare business. Worldwide material and labor availability remain pressured on several fronts, particularity across semi-conductors, resins, and logistics. We are experiencing sustained pressure in our Healthcare business in 3Q, which we expect to continue through the second half of the year, negatively impacting revenue and margin growth. Although we expect a challenging environment through the first half of 2022, we are working with our partners, suppliers, and logistics channels to alleviate the impact and help mitigate output and cost challenges. We’re committed to our full year guidance of low-to-mid single digit revenue growth in Healthcare, with greater than 100 bps of organic margin expansion*.

- How is your Aviation business trending this quarter in light of the latest COVID-19 Delta variant impact?

We continue to closely monitor the impact of the pandemic on our Aviation business. Global GE and CFM departures are now down 25% vs. ’19 levels, recovering from a decline in August departures associated with the Delta variant and government travel restrictions. Overall, departure trends continue to vary regionally. Given the continued lag between departures and shop visits driven by customer behavior, we currently don’t foresee a change to our shop visit expectations that we have provided. However, we continue to watch COVID related travel restrictions and any impact on our Commercial Services portfolio.

For the quarter, we continue to experience supply chain output challenges in Military. Consistent with our 2Q earnings commentary, while we do not expect the 2Q CSA loss contract dynamics to repeat in 3Q, we do expect charges, lower relative to 2Q, as part of our quarterly contract margin review process.

- To what extent does GE’s joint venture with Safran, CFM, utilize factoring and how does that impact GE’s free cash flow*?

CFM International is a company jointly owned in a 50/50 partnership between GE and Safran Aircraft Engines. CFM currently maintains facilities utilized to factor engine invoices, totaling <$2B at the end of 2Q. In accordance with U.S. GAAP, GE does not consolidate any of the JV’s financials, including the factoring facilities utilized by CFM.

CFM has long maintained factoring facilities for the purpose of ensuring that CFM meets its contractual commitments to its partners and customers, along with the internal funding needs of the JV. An increase or decrease in CFM’s factoring facilities or utilization does not directly correlate to a change in cash flow for GE. Utilization levels can vary based upon payment timing from customers, volume of engine shipments, and internal funding needs of the JV, among other reasons. GE’s cash flow only increases from factoring when incremental CFM engines are shipped.

There was a ~$1B variation in CFM’s factoring facility utilization between 2020 and 2021, moving from ~$0.7 billion to ~$1.8B, respectively. This was driven primarily by an early customer payment of previously factored receivables in 4Q’20 and not a significant change in the number of engines factored. As a result, the increased factoring facility utilization did not result in a material cash inflow to GE.

Lastly, the size of the facilities is not always directly related to sales through CFM, but rather to terms with CFM customers. We do not expect changes to these facilities to result in a material headwind or tailwind to GE’s cashflow in the coming years.

For important information about forward-looking statements, please see here.

*Non-GAAP Financial Measure