Today, GE released its fourth-quarter 2019 results which reflect another quarter’s progress on our multiyear transformation. Below are some select highlights from our results, and I encourage you to read the full materials and listen to our earnings call on GE’s investor website.

- Total orders $24.9B, (5)%; organic orders (3)%

- Total revenues (GAAP) $26.2B, (1.0)%; Industrial segment organic revenues* $24.7B, +4.6%

- Industrial profit margin (GAAP) of 6.4%, +460 bps; adjusted Industrial profit margin* 11.3%, +410 bps

- Continuing EPS (GAAP) $0.07, +17%; adjusted EPS* $0.21, +50%

- GE CFOA (GAAP) $4.5B; Industrial free cash flow* $3.9B

Throughout the year, we executed on our 2019 priorities of improving our financial position and strengthening our businesses, starting with Power:

- Reduced GE Industrial leverage, largely driven by reducing net debt* by $7 billion, bringing GE's net debt*/ EBITDA* ratio from 4.8x in 2018 to 4.2x in 2019. Used cash from Wabtec and Baker Hughes transactions to pay down debt, including a $5 billion debt tender. Announced the sale of BioPharma to generate further cash for deleveraging as well as U.S. pension benefit changes to further reduce debt.

- Reduced GE Capital leverage, largely driven by reducing GE Capital debt by $7 billion, bringing GE Capital's debt-to-equity ratio from 5.7x in 2018 to 3.9x in 2019. Completed asset reductions of approximately $12 billion, exceeding the 2019 target of $10 billion and the two-year target of $25 billion.

- Strengthened GE's businesses. Aviation and Healthcare generated profitable growth, Power is stabilizing its businesses, Renewable Energy delivered a steep volume ramp in Onshore Wind to meet customer demand despite mixed performance overall, and GE Capital grew earnings partly through better operations.

- Began to drive Lean transformation and mindset throughout GE. Established common operating processes and metrics and a series of standard operational, talent, strategy and budget reviews. Shifted decision-making and accountability to the businesses, including delayering Power and Renewable Energy.

- Named new leaders, including Carolina Dybeck Happe as Chief Financial Officer (to start in early 2020), Kevin Cox as Chief HR Officer, Pat Byrne as CEO of Digital, Rachel Duan as CEO of Global Growth Organization, John Godsman as VP Business Development, Steve Winoker as VP Investor Relations, and in newly created roles, Monish Patolawala as VP Operational Transformation and Chris Pereira as Chief Risk Officer.

Today, we also announced the following total company outlook for full-year 2020:

- Industrial organic revenue* growth: low-single digits

- Adjusted Industrial organic margin* expansion: 0 to 75 basis points

- Adjusted earnings per share*: $0.50 to $0.60

- Industrial free cash flow*: $2 to $4 billion

Looking forward, we will host an investor call to provide more detail on our 2020 outlook on March 4 at 8:30 a.m. Eastern Time. We will also hold our Annual Meeting of Shareholders on May 5 in Boston, Massachusetts.

As we begin 2020, our path forward will continue to be underpinned by intense customer focus, sharp prioritization, a Lean transformation, and a culture change that rewards candor, transparency and humility. We’re confident in our future and continue to focus on reducing downside risk, increasing upside optionality and setting up GE for long-term success.

Please feel free to reach out with any questions, comments or suggestions. Thank you for your continued interest in GE.

Steve Winoker is the vice president for investor communications at GE.

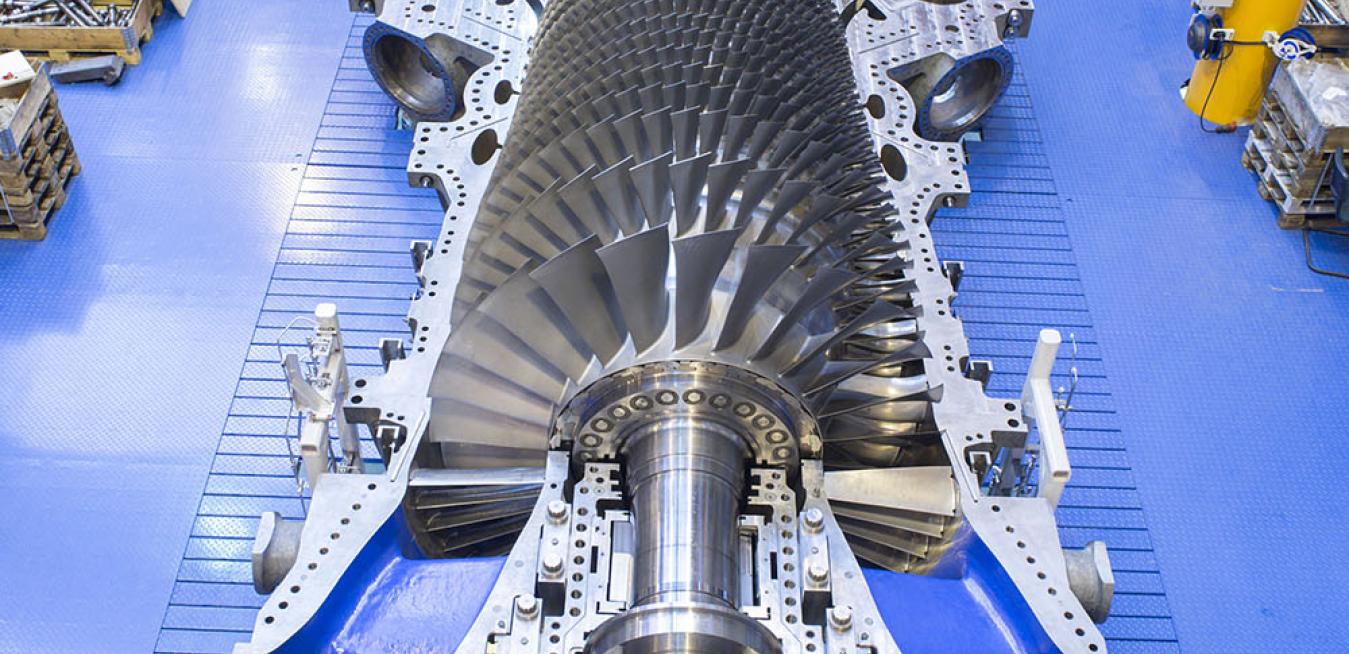

Top image: GE’s next-generation machines include the air-cooled Harriet 9HA turbine — the world’s largest and most efficient gas turbine. Image credit: GE Power.

Important information about our forward-looking statements.

*Non-GAAP Financial Measures:

In this document, we sometimes use information derived from consolidated financial data but not presented in our financial statements prepared in accordance with U.S. generally accepted accounting principles (GAAP). Certain of these data are considered “non-GAAP financial measures” under the U.S. Securities and Exchange Commission rules. These non-GAAP financial measures supplement our GAAP disclosures and should not be considered an alternative to the GAAP measure. The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures are included in our earnings release and the appendix of our investor presentation for the fourth quarter of 2019, as applicable.

Our financial services business is operated by GE Capital Global Holdings LLC (GECGH). In this document, we refer to GECGH as “GE Capital”. We refer to the industrial businesses of the Company including GE Capital on an equity basis as “GE”. “GE (ex-GE Capital)” and /or “Industrial” refer to GE excluding GE Capital.

GE’s Investor Relations website at www.ge.com/investor and our corporate blog at www.gereports.com, as well as GE’s Facebook page and Twitter accounts, contain a significant amount of information about GE, including financial and other information for investors. GE encourages investors to visit these websites from time to time, as information is updated and new information is posted.