I hope this message finds you and your family safe and healthy during this unprecedented time. GE released its first-quarter 2020 results today, and I encourage you to read the full materials and listen to our earnings call on GE’s investor website.

Key points on GE’s financial performance in the quarter:

- Total orders $19.5 billion, (5)%; organic orders (3)%

- Total revenues (GAAP) $20.5 billion, (8)%; Industrial organic revenues* $18.9B, (5)%

- Industrial profit margin (GAAP) of 34.9%, +2,960 bps; adjusted Industrial profit margin* 5.8%, (410) bps

- Continuing Earnings Per Share (EPS) (GAAP) $0.72, including an $11.1 billion after-tax gain following the sale of BioPharma and a $4.6 billion after-tax unrealized loss on marking-to-market GE's investment in Baker Hughes; adjusted EPS* $0.05

- GE Cash Flow From Operating Activities (GAAP) ($1.7B); Industrial free cash flow* of ($2.2B)

Since our Investor Outlook conference call on March 4, COVID-19 has continued to spread rapidly, and the macro environment has drastically deteriorated. While each of our businesses have been impacted, the most significant financial impact to date has been at Aviation and GE Capital Aviation Services (GECAS), where COVID-19 caused a rapid decline in global commercial aviation demand in March. And while our first-quarter financial performance was challenged, we are proud of the work that our colleagues are doing to support the global effort to fight COVID-19.

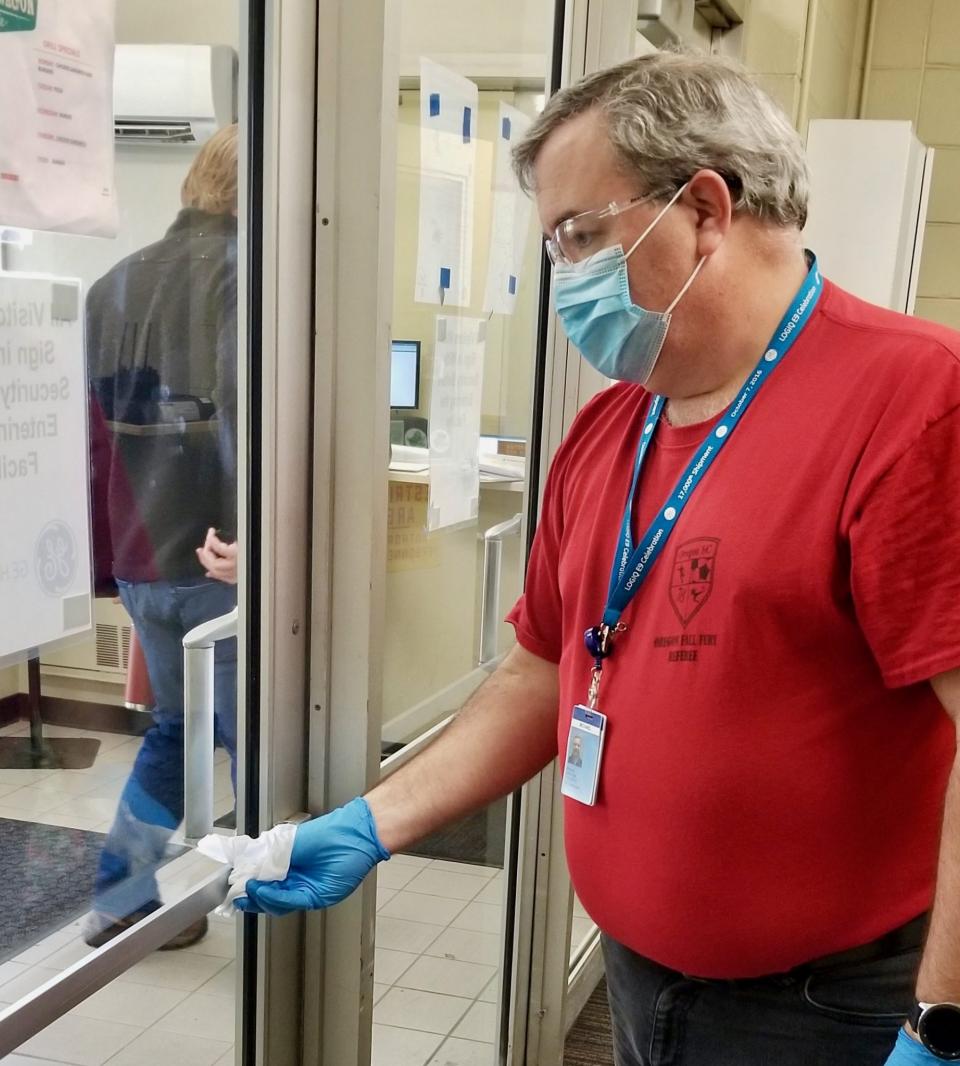

Our CEO, Larry Culp, said, “During this unprecedented pandemic, the GE team is focused on protecting the safety of our employees and communities, serving customers in their critical time of need and preserving our strength for the long term. GE is delivering critical infrastructure and services across the globe, including our teams at Healthcare supporting caregivers who diagnose and treat COVID-19 patients every day."

Each of our businesses and Corporate are taking cost and cash actions to manage risk and proactively mitigate the financial impacts of COVID-19. Across the company, GE is targeting more than $2 billion in operational cost out and more than $3 billion in cash preservation activities in 2020 to improve its cost structure and preserve its ability to serve customers.

Additionally, we remain committed to strengthening our balance sheet. On March 31, we completed the sale of BioPharma to Danaher for ~$20B in net cash proceeds and closed 1Q’20 with ~$47B of cash, cash equivalents and restricted cash. On April 13, we also announced further actions to de-risk and de-lever our balance sheet, which you can read more about here. GE remains committed to achieving its leverage goals, but we now expect to achieve those targets over a longer period than previously announced, due to the impact of COVID-19.

Similar to quarters past, I would also like to highlight some of the enhanced disclosures reflected in the 1Q’20 10-Q and the presentation that was released this morning:

- COVID-19: Disclosures for operational and financial performance impact for total company and segments, actions to protect health and safety of employees, business continuity, cost and cash actions to manage risk, updates to critical accounting estimates and risk factors

- Liquidity and borrowings: Debt offering and tender results, refinance of credit facilities in ordinary course of refinancing process, recent credit ratings actions and impact

- Portfolio actions: BioPharma, BKR investment unrealized loss based on March 31, 2020 share price

- Other updates: 737 MAX agreements for Aviation production rates/terms, GECAS orderbook restructuring/cancellation, current expected credit loss (CECL) adoption impact and additional reserve

- GECAS: Added more portfolio color in the presentation appendix

- Liquidity: Provided our maturities for GE Industrial and GE Capital through 2030 in the presentation appendix

As Larry said today, “While there are many unknowns, there will be another side—planes will fly again, healthcare will normalize and modernize and the world still needs more efficient, resilient energy. We're embracing today's reality and accelerating our multi-year transformation to make GE a stronger, nimbler and more valuable company.”

We appreciate your continued interest in GE, and please take care.

Important information about our forward-looking statements.

*Non-GAAP Financial measures

In this document, we sometimes use information derived from consolidated financial data but not presented in our financial statements prepared in accordance with U.S. generally accepted accounting principles (GAAP). Certain of these data are considered “non-GAAP financial measures” under the U.S. Securities and Exchange Commission rules. These non-GAAP financial measures supplement our GAAP disclosures and should not be considered an alternative to the GAAP measure. The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures are included in our quarterly report on Form 10-Q and the GE earnings supplemental information package posted to the investor relations section of our website at www.ge.com, as applicable.

Our financial services business is operated by GE Capital Global Holdings LLC (GECGH). In this document, we refer to GECGH as “GE Capital”. We refer to the industrial businesses of the Company including GE Capital on an equity basis as “GE”. “GE (ex-GE Capital)” and /or “Industrial” refer to GE excluding GE Capital.

GE’s Investor Relations website at www.ge.com/investor and our corporate blog at www.gereports.com, as well as GE’s Facebook page and Twitter accounts, contain a significant amount of information about GE, including financial and other information for investors. GE encourages investors to visit these websites from time to time, as information is updated and new information is posted.