As we mentioned during our 2Q’19 earnings call on July 31, GE Power has seen early signs of stabilization and these wins are indicative of that. While we are the first to recognize and acknowledge this is a highly competitive market with challenging pricing, we are working hard to improve daily execution, and we remain focused on driving continuous improvement and delivering for our customers. As we think about improving profitability in the segment over time, some data points are worth noting:

We reduced fixed costs in the business by another 10% in 2Q (vs. prior year)

Equipment contribution margin rate on orders over the last 18 months has stepped up to the high single digits. Recall these orders turn to deliveries over the course of quarters to years so it takes time to show up in our reported financials.

We are capturing substantially all of the aftermarket on new HA units primarily from long term agreements or with government related entities where the preference is to work with OEMs, especially around new technology.

Some of our most notable deals for the first half of 2019 include:

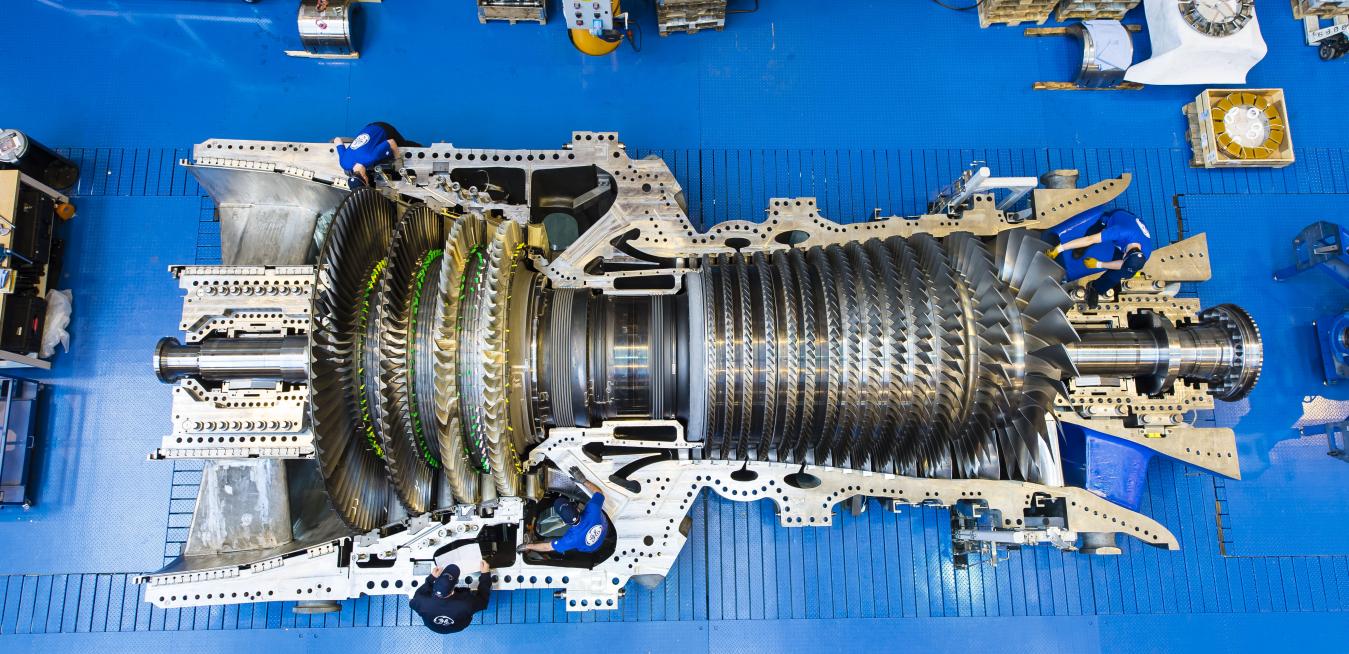

- The DaTan 8&9 power project by Taiwan Power Company that will utilize four of our HA gas turbines and become the third GE HA project in Taiwan.

- An order from Indeck Niles Energy Center in Niles, Michigan to integrate two of GE’s 7HA.02 gas turbines into the approximately 1,000-megawatt power plant project creating one of the most efficient energy centers of its kind in Michigan.

- The very first H-class project in Israel, awarded by the Israel Electric Corporation for the Orot Rabin modernization project that will result in the largest and the most efficient gas power plant in the country.

- Orders for our HA gas turbine technology for the Hill Top Energy Center in Pennsylvania as well as for the Long Ridge Energy Generation LLC Project in Ohio.

I also wanted to provide some context for those of you who subscribe to McCoy and may notice a difference between McCoy’s reporting convention and how GE reports orders for earnings. For example, GE reported 6.7 GW of gas turbine orders for the first half of the year in our 10Q compared to 9.9 GW for GE reported by McCoy. There are frequently some differences between the numbers reported by the technology owner such as GE and those reported by McCoy. This can occur for several reasons – for example, GE may book an order (which gets reported in our 10-Q) where there is a firm contract with financial consideration, but the customer details may remain confidential. However, that order might not show up in the McCoy data aggregation until customer details are released publicly. Similarly, a mismatch might occur due to partner manufacturing relationships where GE is the technology owner, but assembly of the equipment is completed by a local partner who ultimately reports to McCoy when ordered by the end customer. An order for the equipment from the partner to GE does not usually align with the timing of the order for the final product from the end customer to GE’s local partner. This volume typically constitutes < 1 GW in any given quarter.

On a related front, we recently received questions regarding our installed base of 7F units in-service. Our press releases have pointed out that we currently have approximately 900 7F units in service with more than 50M operating hours that account for about 150GW of power. This installed base of 900 units is actually more than the size of our installed base at the end of 2018 which was slightly above the unit count at the end of 2017. In other words, our installed base of 7Fs is still growing. This is confirmed by our product manager in Power who tracks our turbine data and notes that additions continue to outpace retirements which have been minimal. Some of the prior confusion was generated as a result of a marketing brochure which included F-class units other than the 7F. The online marketing brochure has been corrected to avoid any further confusion.

Finally, while we are pleased to be recognized as the segment leader by McCoy and appreciate that our customers continue to demonstrate their confidence in our products and services, I want to reiterate what you’ve heard us say before -- it’s not the primary way we define success. Rather, we are focused on building a sustainable backlog with high quality, profitable orders that we are confident we can execute and deliver value on over the product and service life cycle.

I hope this breakdown is helpful, and as always please don’t hesitate to reach out with questions or comments or other topics where additional information or clarification might be helpful.

Steve Winoker

VP Investor Communications