In the car that whisked the global President and CEO of GE Aviation Services from the final sessions of this month’s 2018 International Air Transport Association AGM in Sydney’s Darling Harbour across town to her next appointment, GE Reports quizzed Jean Lydon-Rodgers on her division’s success and on what has contributed to the growth in GE Aviation Services sales to US$12.6 billion in 2017?

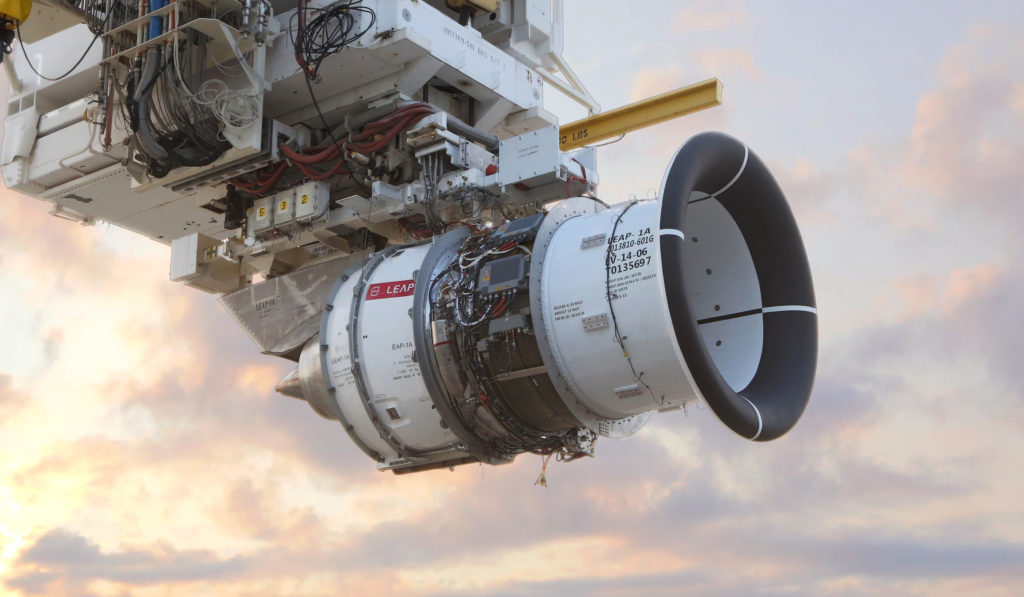

The LEAP engine was developed by CFM International, a 50-50 joint venture between GE Aviation and France’s Safran Aircraft Engines. It is the best-selling engine in CFM’s history. Image credit: CFM International.

The LEAP engine was developed by CFM International, a 50-50 joint venture between GE Aviation and France’s Safran Aircraft Engines. It is the best-selling engine in CFM’s history. Image credit: CFM International.One factor is that new jet engines such as the LEAP series, which powers the Airbus A320neo, Boeing 737 MAX and China’s COMAC C919, are entering the air space with service contracts already in place, where previously they may have been a later thought.

“Customers right now are making decisions, especially with the next-generation engines, to buy a service contract together with the new equipment,” says Lydon-Rodgers. “As the technology matures on wing, customers want assurance that the engines will meet the expectations we promised in the sales campaign.” The most efficient way to achieve that, she says, is through a rate-per-flying-hour services agreement, such as GE’s tailored TrueChoice Flight Hour package, under which an airline “turns all the engine-maintenance needs over to us, as the original equipment manufacturer” (OEM).

“Think about a new engine,” she says. “If an issue does arise, the responsiveness a customer will get from GE is far better than if they went through a third party who is not familiar with the technology and would have to call us anyway. The direct connection to the OEM is a much more comfortable situation for operators when they go into service with a new aircraft.”

Some 40 global carriers currently operate around 250 aircraft powered by the new LEAP engines, which are manufactured by CFM International, the 50/50 joint venture between GE and France’s Safran Aircraft Engines. GE’s support network for CFM engines already includes more than 60 customer support managers, three customer-support and diagnostic centres and 250 global field-service engineers. With a pipeline of orders for LEAP ultra-fuel-efficient and reliable engines that already surpasses the 15,000 mark, GE is poised with current deep expertise and five training centres on three continents to scale up engineering to meet upcoming maintenance demand.

Cargo lifts demand for workhorse engines

So far, so interesting, but then Lydon-Rodgers adds the cargo factor: “Cargo operations driven by e-commerce are seeing the reemergence of aircraft such as the 767 and the 747 powered by our CF6 engines.” The CF6 series first entered service in 1971. Renowned for its operational record, it has accumulated more than 430 million flight hours.

It’s destined to live on. IATA reports that demand for air freight rose 9% over 2017, and that the outlook for 2018 is optimistic, driven also by the need to transport time- and temperature-sensitive goods such as pharmaceuticals and technology. With cargo operators both buying new freighters and converting passenger aircraft for cargo duty, “an engine we thought would begin to be phased out of service due to retirement of the aircraft it’s designed for, is very likely to continue for a couple more decades,” says Lydon-Rodgers.

Digitisation supercharges service responsiveness

As the volume of engines in service increases, GE is constantly refining its service operations to deliver the lowest cost of ownership throughout the lifecycle of its technologies. Digital applications based in GE’s Predix operating system for the industrial internet have streamlined administration of service contracts with tools such as ClearView Invoicing, and continue to hone predictive maintenance procedures.

“Onboard engine sensors feed prognostic monitoring to tell us when an engine will come in to the overhaul shop. We can reliably predict not only the timing of the service but what the work scope will require in detail: such as whether we need to go into the compressor, and the likelihood of parts needing to be replaced or repaired,” says Lydon-Rodgers. This in turn informs the supply chain of parts and expertise required to handle upcoming demand. “Such tools improve the speed with which we can get an engine back out to the customer — back on wing, generating revenue.”

Lydon-Rodgers is passionate about the engine-service business. Although her original training was as an electrical engineer, she subsequently spent eight years with GE Aviation in evaluation and test engineering, supporting the development and certification of engines such as the CFM56, GE90, the famed CF6 and GP7200. “You just get the bug,” she says, “spending that much time around an aircraft engine, this very powerful machine, with the smell of jet fuel...”

Technical program management and leadership roles on the military side of GE Aviation further broadened Lydon-Rodgers’ expertise and understanding of evolving customer needs.

In 2017 Singapore Airlines signed a 12-year TrueChoiceTM Flight Hour agreement with GE Aviation for the maintenance, repair and overhaul of its 45 GE9X engines that will power its Boeing 777-9 aircraft. Image credit: Boeing.

In 2017 Singapore Airlines signed a 12-year TrueChoiceTM Flight Hour agreement with GE Aviation for the maintenance, repair and overhaul of its 45 GE9X engines that will power its Boeing 777-9 aircraft. Image credit: Boeing.At the 2018 IATA AGM, she was proud to hear customers in praise of GE engines. “So many customers expressed their gratitude for the ability of our engines to serve them well. Knowing that they feel they made the right choice in competitive campaigns where they had other choices — that makes you feel really good.”

Lydon-Rodgers also valued the opportunity in Sydney to tap into what she calls “constructive” feedback from customers at the CEO level. “When a customer says that something needs to be addressed, whether it’s a technical or a commercial issue, we can really understand which challenges make it to the C-suite offices. It helps us to effectively target our response and work on the right things.”

As she alights from the car, Lydon-Rodgers fires one last competitive salvo that explains the success of GE Aviation Services. “We want our engines to always be the product of choice. When a customer is trying to make a decision about potentially retiring an aircraft, we want, through our service offering and our lowest-cost-of-ownership solutions, to enable them to make the decision to keep the GE engine and potentially retire our competitors’ products.”