GE released its first quarter results today, and I encourage you to read the full materials and listen to our earnings call at 8:00 AM ET.

Key highlights on GE’s financial performance for 1Q’22:

- Total orders $18.9B, +11%; organic orders +13%

- Total revenues (GAAP) $17.0B, flat; adjusted revenues* $16.3B, +0.8% organically*

- Profit margin (GAAP) of (3.1)%,(450) bps; adjusted profit margin* 5.8%, +110 bps organically*

- Continuing EPS (GAAP) of $(0.74), $(0.75); adjusted EPS* $0.24, +$0.11

- Cash from Operating Activities (GAAP) $(0.5)B, +$2.1B; free cash flow* $(0.9)B, +$2.5B, ex. disc. factoring* +$1.7B

GE Chairman and CEO H. Lawrence Culp, Jr. said, “This quarter, the GE team improved services, orders, and cash while scaling lean in all businesses to drive margin expansion. Our continuous operational improvements set us up to reinvest in innovation across GE, and our businesses remain focused on growth, supported by continued recovery at Aviation and strong demand at Healthcare. We're holding the outlook range we shared in January, but as we continue to work through inflation and other evolving pressures, we're currently trending toward the low end of the range. Importantly, we remain on track to launch three independent, investment-grade companies with leading positions in growing, critical sectors, well positioned to create long-term value.”

In our businesses, Aviation continues to see recovery momentum, with strong growth led by Commercial Services. At Healthcare, while demand remains strong, we’re continuing to experience pressure due to both inflation and supply chain constraints. Renewable Energy equipment was pressured due to inflation and reduced demand in North America Onshore Wind. In Power, we saw continued improvement, with growth in organic orders*, organic services revenue* and profit.

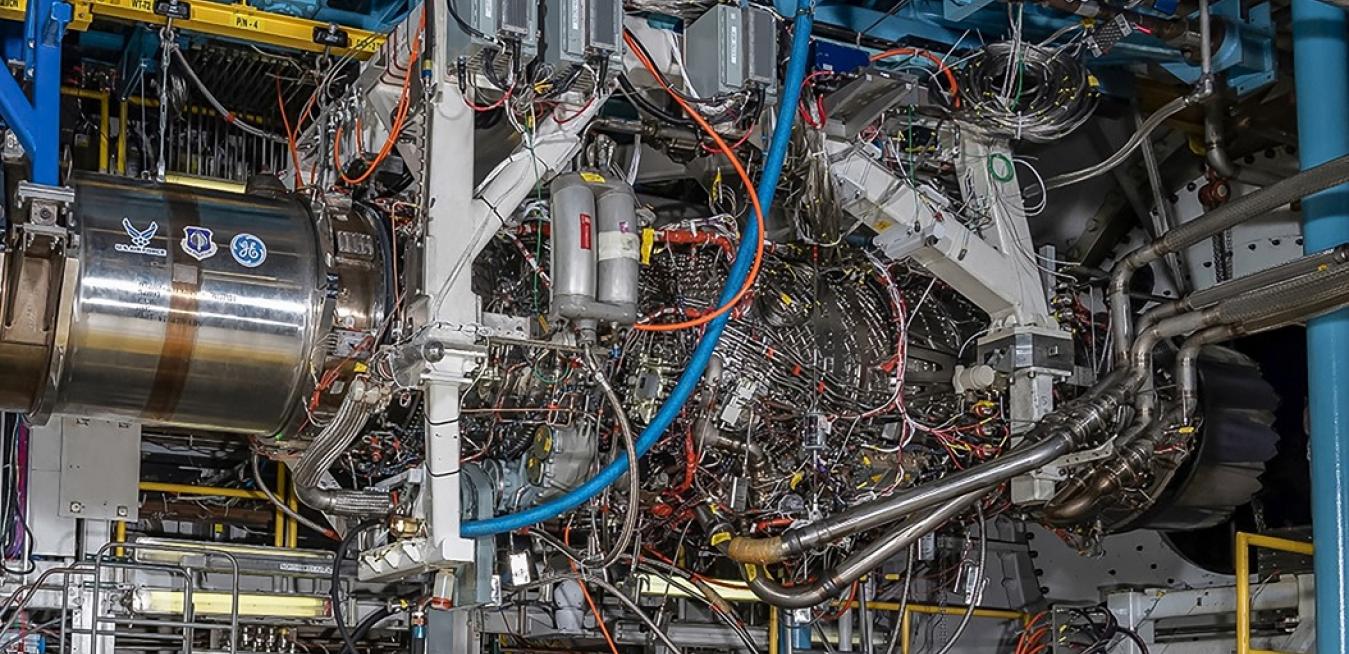

Our businesses are taking actions to drive growth, price, and cost out. We’re growing our high-margin services businesses and reconfiguring our supply chains to navigate continued challenges, while investing in innovation. Across GE, we have many recent examples to highlight, including our partnership with Boeing on a hybrid electric flight test demonstration program; the development of the Edison Digital Health Platform, which – powered by AI – will aggregate data from multiple sources and vendors to help reduce staff burden and improve care coordination. We’re also raising list prices and price floors, and using escalation clauses in our service contracts. And we’re focused on sourcing and productivity to reduce costs. While there’s a lot to do, we’re confident these are lasting improvements.

Looking ahead, we remain on track with our plans to launch three independent, investment grade, industry-leading companies focused on the future of flight, precision health, and the global energy transition. The planned Healthcare spin is well underway, and we remain on course to launch Healthcare in early 2023. Our businesses are positioned for success in three industries poised to accelerate, and we’re focused on scaling lean and driving innovation while delivering better results for our shareholders.

We look forward to keeping you updated on our progress and appreciate your continued interest in GE.

Best,

Steve

*Non-GAAP Financial Measure. The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures are included in our Form 10-Q and our first quarter earnings release.

This document contains "forward-looking statements." For details on the uncertainties that may cause our actual future results to be materially different than those expressed in our forward-looking statements, see here as well as our Form 10-Q for period ended March 31, 2022.